Vape Mojo: Your Ultimate Vape Resource

Explore the latest trends, tips, and reviews in the world of vaping.

Whole Life Insurance: The Unseen Superhero of Your Financial Plan

Discover why whole life insurance is the ultimate superhero of financial planning—protect your family and grow your wealth at the same time!

Understanding Whole Life Insurance: A Deep Dive into Its Benefits

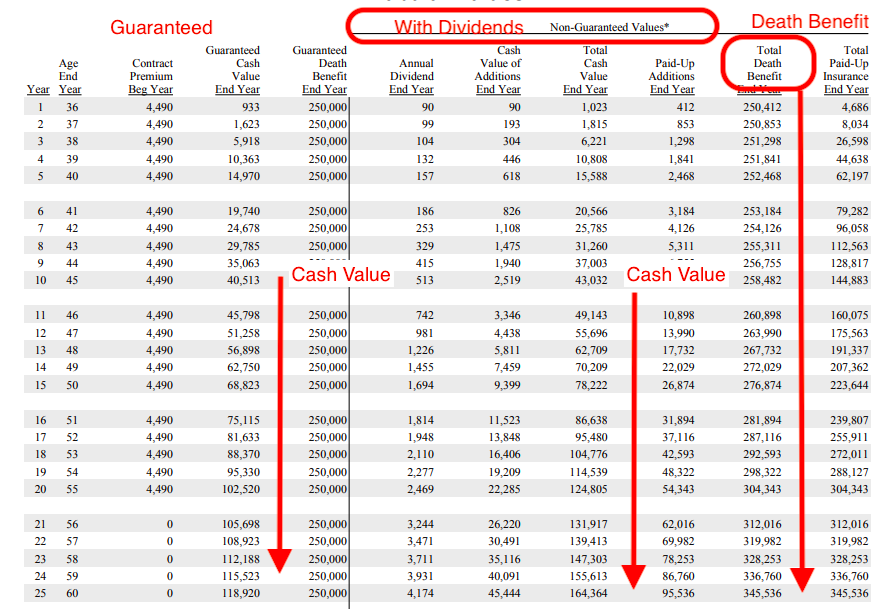

Whole life insurance is a type of permanent life insurance that provides coverage for the insured's entire lifetime, as long as premiums are paid. This policy not only offers a death benefit to beneficiaries but also accumulates cash value over time, making it a unique financial product. Among its many benefits, whole life insurance provides a steady growth of cash value, which can be borrowed against or withdrawn during the policyholder's lifetime. This feature offers a sense of financial security and peace of mind, knowing that the policy can serve as a source of funds in emergencies or unexpected situations.

In addition to the cash value benefits, whole life insurance also guarantees a fixed premium throughout the policyholder's life. This means that as an individual ages, they won’t face increasing premiums that are common with term life insurance. Furthermore, the death benefit is typically guaranteed and can help provide financial security for loved ones, covering expenses like funeral costs, outstanding debts, or even college tuition for children. Ultimately, understanding the intricacies of whole life insurance and its benefits can empower individuals to make informed decisions about their long-term financial planning.

Is Whole Life Insurance Right for You? Key Questions Answered

When considering whether whole life insurance is right for you, it’s essential to evaluate your financial goals and needs. Whole life insurance offers lifelong coverage, as opposed to term insurance, which is only valid for a specific period. This type of policy builds cash value over time, which can serve as a financial resource for emergencies or loans. However, the premiums are typically higher than those of term insurance. To determine if it fits your needs, ask yourself these key questions:

- What are my long-term financial goals?

- Am I looking for a policy that accumulates cash value?

Another critical consideration is your current financial situation. The higher premiums of whole life insurance may not be suitable for everyone. It’s important to analyze your budget and other financial commitments. Moreover, consider your age and health as they can significantly impact premiums. Whole life insurance can be a valuable tool for wealth transfer, but it might not be ideal for early-career individuals or those with limited budgets. Reflecting on these aspects can help you make an informed decision. Remember to ask yourself:

- Can I commit to higher premium payments?

- Do I have sufficient savings or investments to diversify my financial portfolio?

The Long-Term Financial Security of Whole Life Insurance: What You Need to Know

Whole life insurance is often lauded for its ability to provide long-term financial security to policyholders. Unlike term life insurance, which offers coverage for a limited time, whole life policies are designed to last a lifetime, ensuring that your beneficiaries are financially protected no matter when you pass away. This type of insurance not only delivers a death benefit but also accumulates cash value over time, which can be borrowed against or withdrawn, providing you with a financial resource in emergencies or significant life changes.

When considering whole life insurance for long-term financial security, it's essential to understand the policy's structure. The premium payments typically remain level throughout your life, offering predictable expenses. Additionally, the cash value grows at a guaranteed rate, which can serve as a stable investment component in your overall financial strategy. However, buyers should conduct thorough research and consult with financial professionals to assess how a whole life policy aligns with their financial goals and needs.