Vape Mojo: Your Ultimate Vape Resource

Explore the latest trends, tips, and reviews in the world of vaping.

Trading Gold: The Glittering Path to Wealth

Uncover the secrets of gold trading and unlock your path to wealth! Start your journey to riches today!

Understanding the Basics: How to Start Trading Gold

Gold trading can be a lucrative investment strategy, but understanding the basics is crucial before diving in. Start by researching the gold market, which is influenced by various factors including economic stability, inflation rates, and geopolitical events. Many traders prefer to utilize instruments such as futures, options, and exchange-traded funds (ETFs) to gain exposure to gold. By familiarizing yourself with these terms and trading mechanisms, you can make informed decisions and reduce risks associated with market volatility.

Before you begin trading, consider setting up a trading plan. This plan should outline your investment goals and risk tolerance. It's also important to choose a reliable trading platform that offers user-friendly tools and resources. As a beginner, you might want to start with a demo account to practice your strategies without risking real money. Once you feel comfortable, you can transition to a live account. Remember, staying updated on market trends and continuously educating yourself about gold trading will significantly enhance your chances of success.

Top Strategies for Successful Gold Trading

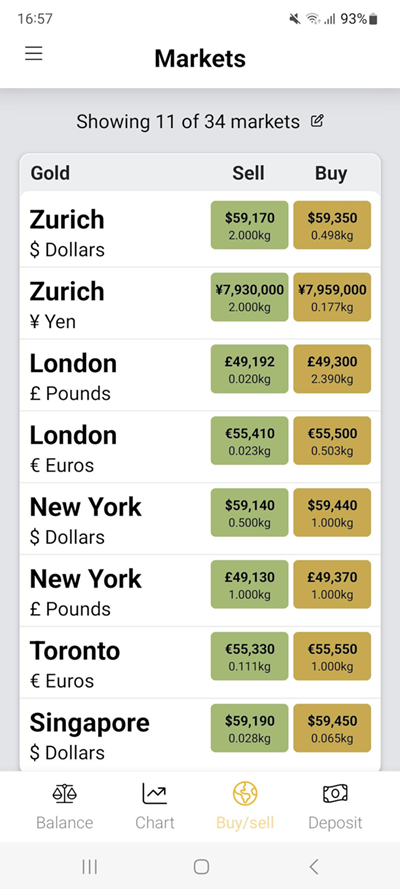

Gold trading has become increasingly popular among investors seeking to diversify their portfolios and hedge against market volatility. One of the top strategies for successful gold trading is to stay informed about global economic indicators that influence gold prices. Factors such as inflation rates, interest rates, and geopolitical tensions can all impact the demand for gold. To enhance your trading strategy, consider creating a watchlist of major economic events and reports, and monitor how these news releases affect gold prices. Additionally, utilizing technical analysis can help you identify trends and entry/exit points, enabling you to make informed trading decisions.

Another essential strategy for successful gold trading involves managing risk effectively. This can be achieved through the use of stop-loss orders, which allow you to limit potential losses by setting predetermined exit points for your trades. Furthermore, it is crucial to diversify your investments within the gold market by exploring various trading instruments such as gold ETFs, futures, and physical gold. By spreading your investments, you can reduce exposure to market fluctuations and enhance overall profitability. Remember, consistent evaluation and adjustment of your trading strategy are key to navigating the ever-changing gold market.

Is Gold Trading a Safe Investment in Today’s Market?

Gold trading has long been regarded as a safe investment, especially during times of economic uncertainty. Unlike traditional stocks or bonds, gold is a tangible asset that tends to retain its value when the market is volatile. Investors often turn to gold as a hedge against inflation, currency devaluation, and geopolitical tensions. However, while gold can provide a sense of security, potential investors should consider various factors before diving into gold trading, including market trends and economic indicators that can influence gold prices.

In today's market, the question of whether gold trading is a safe investment is complex. On one hand, gold often performs well during downturns, making it an appealing choice for risk-averse investors. On the other hand, gold prices can still experience significant fluctuations based on supply and demand dynamics, interest rates, and investor sentiment. Therefore, it's essential for potential investors to conduct thorough research and possibly consult with financial experts to determine if gold trading aligns with their investment goals and risk tolerance.