Vape Mojo: Your Ultimate Vape Resource

Explore the latest trends, tips, and reviews in the world of vaping.

Term Life Insurance: Your Ticket to Peace of Mind

Discover how term life insurance can secure your family's future and grant you peace of mind. Protect what's most important today!

Understanding Term Life Insurance: Benefits and Coverage Explained

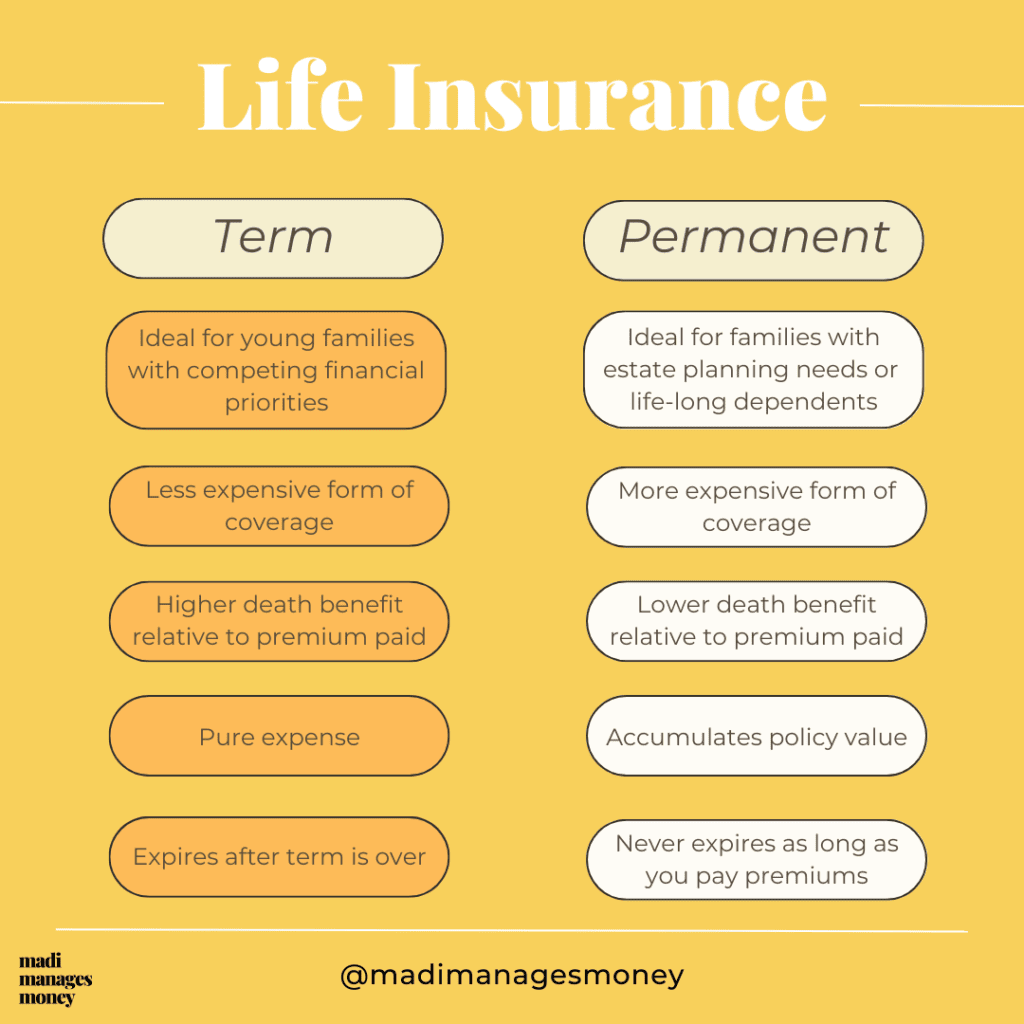

Term life insurance is a type of life insurance policy that provides coverage for a specified period, typically ranging from 10 to 30 years. This insurance is designed to offer financial protection for your loved ones in the event of your untimely passing during the term. One of the key benefits of term life insurance is its affordability; it usually comes with lower premium rates compared to whole life insurance. As a result, many individuals opt for this coverage to ensure their family will have funds to cover essential expenses like mortgage payments, education costs, and daily living expenses if the primary breadwinner is no longer there to provide support.

Additionally, term life insurance offers a simple structure that makes it easy to understand. Policyholders can choose coverage amounts and duration based on their specific needs. At the end of the term, the policy may expire without any payout if the insured individual survives the period, but many policies allow for the option to convert to whole life insurance or renew for an additional term. This flexibility is crucial for those whose circumstances may evolve over time. In conclusion, understanding the benefits and coverage options of term life insurance enables individuals to make informed decisions that can significantly impact their financial security and peace of mind.

Is Term Life Insurance Right for You? Key Factors to Consider

When considering term life insurance, it's important to evaluate your unique financial situation and long-term goals. Unlike permanent life insurance, which covers you for life and often includes a savings component, term life offers coverage for a specific period, typically ranging from 10 to 30 years. This can be an attractive option for those looking to provide financial security for their families until their children grow up or their mortgage is paid off. Factors such as your age, health, and financial obligations play a crucial role in determining if term life insurance is the right fit for you.

Additionally, understanding your budget is essential when selecting a policy. Term life insurance tends to be more affordable than whole life policies, making it easier to find a plan that fits into your monthly expenses. However, it's vital to assess how much coverage you need and for how long. Consider creating a list of your current debts, future expenses (like college tuition), and any income you want to replace in case of an unforeseen event. By doing this, you'll have a clearer picture of how much coverage is necessary for protecting your loved ones, allowing you to make a well-informed decision.

How to Choose the Best Term Life Insurance Policy for Your Needs

Choosing the best term life insurance policy for your needs involves several key considerations. First, you should assess your financial obligations, including debts, mortgage payments, and any dependents' needs. This will help determine how much coverage you should aim for. Additionally, consider the policy's term length; most people choose between 10, 20, or 30 years based on their life stage and financial goals.

Next, compare quotes from various insurance providers to find a policy that offers the best value. Don't just focus on the premium costs; examine factors like coverage limits and the insurer's financial stability. Reading customer reviews and asking for recommendations can also provide insight into the claims process and customer service experience. Remember, the goal is to find a term life insurance policy that meets your specific needs while providing peace of mind.