Vape Mojo: Your Ultimate Vape Resource

Explore the latest trends, tips, and reviews in the world of vaping.

Rev Up Your Savings with These Auto Insurance Deals

Discover unbeatable auto insurance deals and supercharge your savings today! Don't miss out on these exclusive offers!

Top 5 Tips to Find the Best Auto Insurance Deals

Finding the best auto insurance deals can seem overwhelming, but with a little research and strategy, you can save a significant amount of money. Here are five expert tips to guide you in your search:

- Compare Quotes: Always gather quotes from multiple insurance providers. This will give you a clear understanding of the typical rates in your area and help you identify the best deal.

- Understand Coverage Options: Evaluate the different types of auto insurance coverage available, such as liability, collision, and comprehensive. Knowing what you need will prevent you from paying for unnecessary coverage.

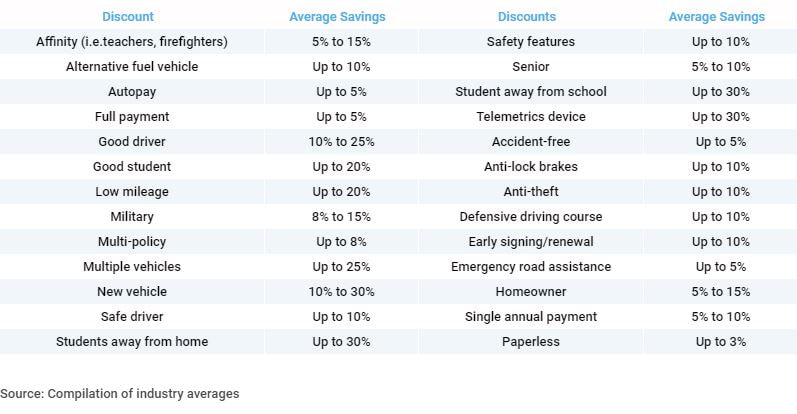

Additionally, don't overlook the importance of discounts. Many insurers offer discounts for safe driving, bundling policies, or being a member of certain organizations. Ask about all possible discounts before making a decision. Lastly, consider your state’s regulations and how they might affect your insurance costs; some states have higher minimum coverage requirements that can lead to higher premiums. By following these tips, you can increase your chances of finding the best auto insurance deals available.

How to Maximize Your Auto Insurance Savings

Saving money on auto insurance is achievable with a few strategic steps. First, compare quotes from multiple providers to ensure you're getting the best deal. Websites and apps can make this process quick and easy, allowing you to input your information once and receive several estimates. Additionally, consider adjusting your coverage options; for instance, raising your deductible can lower your premium significantly. Just make sure you have enough savings to cover that deductible in case of an accident.

Another effective method to maximize your auto insurance savings is by taking advantage of available discounts. Many insurers offer discounts for various reasons such as good driving records, bundling policies, or having safety features in your vehicle. Don't hesitate to ask your insurance agent about possible savings. Lastly, reviewing and updating your policy regularly can help you identify and eliminate unnecessary coverage, further reducing your costs.

Are You Paying Too Much for Auto Insurance? Discover Affordable Options

Are you wondering if you are paying too much for auto insurance? Many drivers are surprised to find that they might be overpaying for their coverage. The first step in discovering affordable options is to analyze your current policy. Look at the coverage limits, deductibles, and any additional features that may not be necessary for your situation. Comparing quotes from different providers can help you identify potential savings. Don't forget to factor in discounts that may apply, such as safe driver discounts or bundling policies.

Once you've assessed your current policy, consider exploring alternative coverage options. Many insurance companies offer basic liability coverage at significantly lower premiums than comprehensive policies. Additionally, check for local or online insurance providers that might not be on your radar. You might also want to evaluate if raising your deductible can decrease your premium. By being proactive and informed, you have a better chance of finding a policy that offers adequate coverage without breaking the bank.