Vape Mojo: Your Ultimate Vape Resource

Explore the latest trends, tips, and reviews in the world of vaping.

Investing in Stocks: Are You Playing Checkers While Everyone Else Plays Chess?

Unlock the secrets of smart investing! Are you stuck in checkers while others play chess? Discover the winning strategies today!

Understanding the Long Game: Strategies in Stock Market Investing

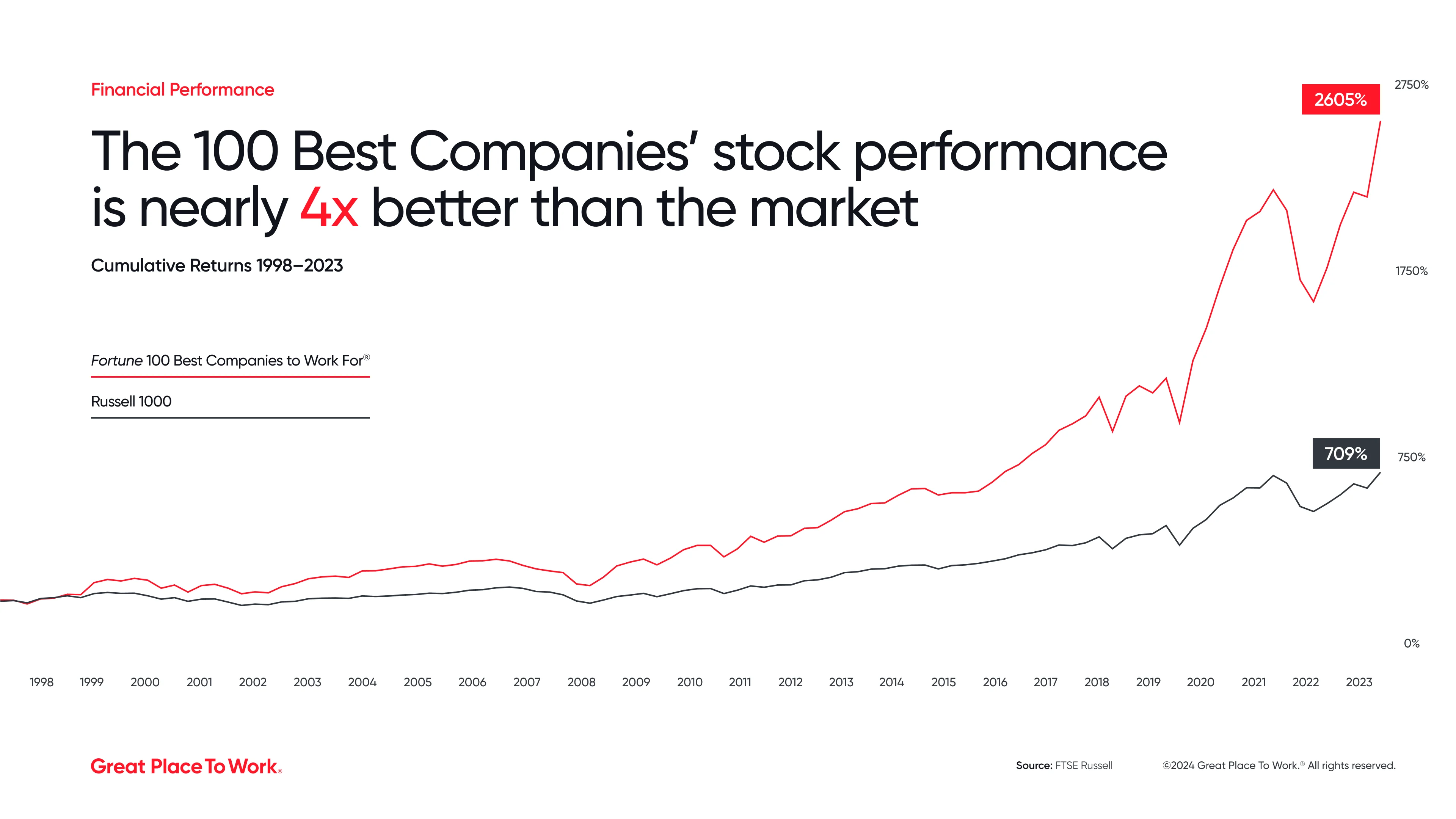

Investing in the stock market is often perceived as a quick way to generate wealth, but seasoned investors understand the significance of playing the long game. This approach involves developing a strategic plan that considers long-term goals rather than short-term gains. By focusing on the fundamentals of companies, maintaining a diversified portfolio, and being patient, investors can allow their investments to appreciate over time, benefitting from compounding returns. Key strategies include investing in established companies with a proven track record and regularly reviewing your portfolio to ensure it aligns with your financial goals.

Another crucial element in mastering the long game is understanding market cycles and the importance of emotional discipline. Markets experience fluctuations, and remaining calm during downturns can be challenging. To navigate this, investors should establish a clear investment policy statement and stick to it, avoiding the temptation to react impulsively to market news. Incorporating dollar-cost averaging into your strategy can also help mitigate the risks of market volatility by investing a fixed amount consistently, regardless of market conditions. By adopting these strategies, investors can position themselves for long-term success in the ever-evolving landscape of stock market investing.

Are You Ready to Think Like a Chess Master in Your Investment Decisions?

Investing is not just about numbers and charts; it requires a mindset akin to that of a chess master. Just as a chess player considers their opponent's moves and possible strategies, an investor must analyze market trends and anticipate future developments. Thinking critically and assessing various scenarios can help you avoid common pitfalls and seize opportunities. Like a well-planned chess game, your investment strategy should be methodical, deliberate, and adaptable to the ever-changing market landscape.

Moreover, mastering the art of investment involves understanding the long-term implications of your decisions. Chess masters think several moves ahead, weighing the potential outcomes of each action. In the same vein, successful investors must evaluate the risks and benefits of their choices over time. By developing this forward-thinking approach, you can make more informed decisions that align with your financial goals, ultimately setting the stage for both short-term gains and long-term wealth accumulation.

The Importance of Patience and Strategy in Stock Trading: Avoiding Common Pitfalls

Patience and strategy are crucial elements in the realm of stock trading. Many new traders fall into the trap of making impulsive decisions based on short-term market fluctuations, leading to significant losses. To avoid these pitfalls, it's essential to develop a structured trading plan that includes clear goals and risk management techniques. By adhering to this plan, traders can resist the temptation to react emotionally to market changes and instead make calculated moves that align with their long-term objectives.

Furthermore, cultivating patience allows traders to wait for the right opportunities rather than jumping at every potential profit. Here are some common pitfalls that can be avoided by integrating strategy and patience into stock trading:

- Chasing after hot stocks without research

- Overreacting to market news

- Ignoring stop-loss orders

- Neglecting to analyze past trading performance

By being mindful of these traps and focusing on a disciplined approach, traders can significantly enhance their chances of long-term success.