Vape Mojo: Your Ultimate Vape Resource

Explore the latest trends, tips, and reviews in the world of vaping.

Disability Insurance: Your Safety Net or a Costly Mistake?

Discover if disability insurance is your financial safety net or a costly mistake. Uncover the truth and protect your future today!

Understanding Disability Insurance: Is It Worth the Investment?

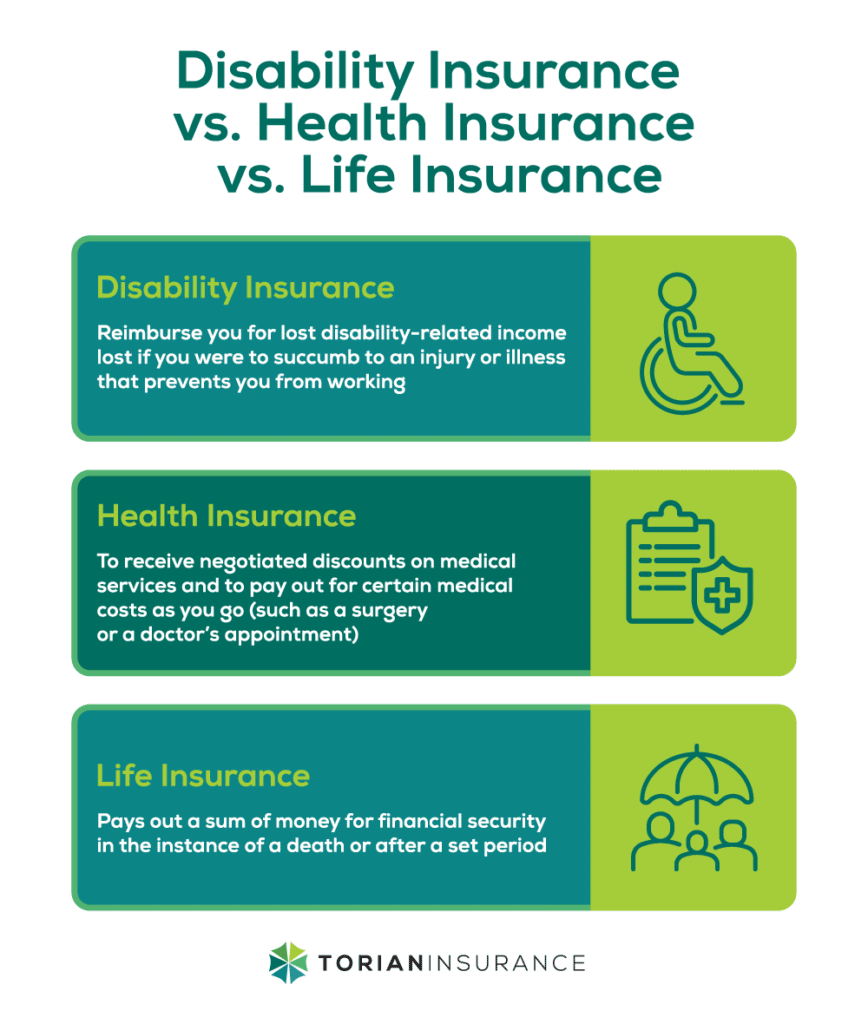

Understanding disability insurance is essential for everyone, especially those who rely heavily on their income to support themselves or their families. This type of insurance provides a safety net in case an unforeseen event, such as illness or an accident, prevents you from working. The question arises: is it worth the investment? To answer this, one must consider factors such as current income level, health status, and job security. For many individuals, the financial implications of a temporary or permanent disability can be devastating. Thus, disability insurance can act as a crucial buffer, ensuring a steady income flow during challenging times.

Moreover, there are two main types of disability insurance policies: short-term and long-term. Short-term disability insurance typically provides coverage for a few months up to a year, while long-term disability insurance can extend benefits for several years or even until retirement age. Investing in disability insurance offers peace of mind, knowing that you are financially protected in case of life-altering events. Ultimately, assessing your personal circumstances against the potential risks can help determine if this investment is prudent for your future stability.

Top 5 Myths About Disability Insurance Debunked

Disability insurance is often misunderstood, leading to several prevalent myths that can prevent individuals from making informed decisions. One common myth is that disability insurance is only for people in high-risk jobs. In reality, anyone, regardless of their occupation, can experience an illness or accident that impacts their ability to work. This is why it’s critical to debunk these myths and shed light on the true nature and importance of disability insurance.

Another myth is that government programs are sufficient for income replacement during disability. While programs like Social Security can provide some support, they often fall short of covering essential living expenses. According to experts, relying solely on government assistance can lead to significant financial strain. Understanding these misconceptions helps individuals better prepare and protect their financial future with the right disability insurance policy.

Disability Insurance vs. Emergency Savings: What's Best for You?

When it comes to financial security, Disability Insurance and Emergency Savings serve crucial but different roles. Disability Insurance provides a safety net in the event you are unable to work due to illness or injury, ensuring a portion of your income is replaced. This type of insurance can be particularly vital for those whose families rely on their earnings. On the other hand, having an Emergency Savings fund allows you to manage unexpected expenses, such as medical emergencies or car repairs, without disrupting your day-to-day living. It is generally recommended to save three to six months' worth of living expenses in an emergency fund to provide adequate coverage during tough times.

Ultimately, deciding between Disability Insurance and Emergency Savings hinges on your individual circumstances. If you have a stable job and a strong emergency fund in place, investing in Disability Insurance might be more beneficial, protecting your income in case of a long-term impairment. Conversely, if you are self-employed or have inconsistent income, prioritizing an Emergency Savings fund could offer immediate relief for unforeseen expenses, thus preventing financial strain. Assess your financial situation carefully to determine which option aligns best with your needs and offers you the peace of mind to navigate life's uncertainties.