Vape Mojo: Your Ultimate Vape Resource

Explore the latest trends, tips, and reviews in the world of vaping.

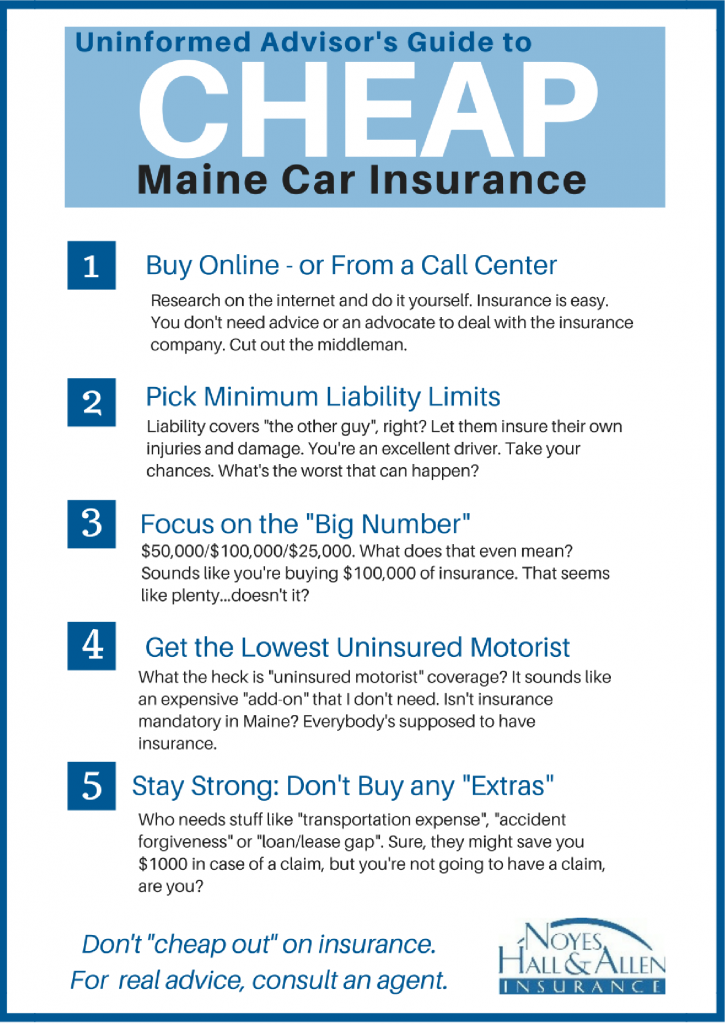

Cheap Thrills: Insurance You Can Actually Afford

Unlock affordable insurance solutions that won't break the bank! Discover budget-friendly options and save on your peace of mind today.

Understanding Basic Coverage: What You Need to Know About Affordable Insurance

When it comes to understanding basic coverage in insurance, it is crucial to familiarize yourself with the essential components that make up your policy. Affordable insurance options often provide the necessary protection without overwhelming you with complicated jargon. One primary aspect to consider is liability coverage, which protects you in case of accidents where you are deemed at fault. Additionally, your policy may include coverage for property damage and medical expenses, ensuring that you are financially secure in unexpected situations. Always review the terms to ensure that your needs are adequately met.

Another important factor in finding affordable insurance is understanding the various types of coverage available to you. Here are a few key types to consider:

- Comprehensive Coverage: Protects against theft, fire, and other non-collision incidents.

- Collision Coverage: Covers damage to your vehicle from accidents, regardless of fault.

- Personal Injury Protection: Covers medical expenses for you and your passengers following an accident.

Top 5 Affordable Insurance Options for Every Budget

Finding the right insurance can feel overwhelming, especially when you're on a tight budget. Fortunately, there are several affordable insurance options available that cater to various needs. Whether you're looking for health, auto, or renter’s insurance, there are plans designed to ensure you’re covered without breaking the bank. In this article, we’ll explore the top 5 affordable insurance options for every budget.

- Basic Health Insurance: Affordable health insurance plans often cover essential services and help manage healthcare expenses.

- State Minimum Auto Insurance: This type of insurance meets the legal requirements in your state at a lower cost.

- No-Frills Renter’s Insurance: These plans provide essential coverage for your personal belongings without unnecessary add-ons.

- Short-Term Health Insurance: Great for those who need temporary coverage, these plans are typically less expensive.

- Group Health Insurance: Often provided by employers, group plans allow you to benefit from lower rates and comprehensive coverage.

Is Cheap Insurance Worth It? Debunking Common Myths

The question of whether cheap insurance is worth it often stems from misconceptions about what affordable coverage entails. Many people believe that low premiums automatically mean poor service or inadequate protection. However, it's essential to understand that not all budget-friendly policies compromise quality. In fact, many reputable insurance companies offer competitive rates without sacrificing coverage. By comparing policies and understanding the specifics of each offer, consumers can find plans that fit their needs without breaking the bank. Debunking this myth can empower consumers to make informed choices rather than succumbing to fear based on price alone.

Another common myth is that cheap insurance is only suitable for young or low-risk individuals. In reality, budget-friendly insurance options exist for people of all ages and risk categories. Insurers often consider various factors, such as driving history, location, and coverage requirements, when determining rates. For instance, individuals with a clean driving record may qualify for substantial discounts, even with higher coverage limits. By educating yourself about the various factors that influence insurance pricing, you can find affordable solutions that still offer comprehensive protection, thereby debunking the myth that low-cost policies are solely for a particular demographic.