Vape Mojo: Your Ultimate Vape Resource

Explore the latest trends, tips, and reviews in the world of vaping.

Banks 101: Why Your Money Might Be Better Off Under a Mattress

Discover why your cash might be safer under a mattress than in a bank! Uncover shocking truths about banking you need to know.

The Hidden Costs of Banking: Are You Losing More Than You Think?

When it comes to managing your finances, banking often appears straightforward. However, beneath the surface lies a web of hidden costs that could be draining your resources without your even realizing. For instance, monthly maintenance fees, overdraft charges, and ATM withdrawal fees can quickly accumulate, often leading customers to spend far more than they initially planned. According to industry estimates, these unsuspecting expenses can add up to hundreds of dollars each year, prompting the question: are you truly aware of what you're paying for?

In addition to direct fees, there are also invisible costs associated with poor banking choices. For example, having a low credit score due to missed payments can result in higher interest rates on loans and credit cards, ultimately costing you thousands in the long run. Furthermore, over-relying on credit can lead to a cycle of debt that is difficult to escape. Understanding these hidden elements is crucial for anyone looking to maximize their banking efficiency and retain more of their hard-earned money.

Under the Mattress vs. In the Bank: The Real Value of Your Savings

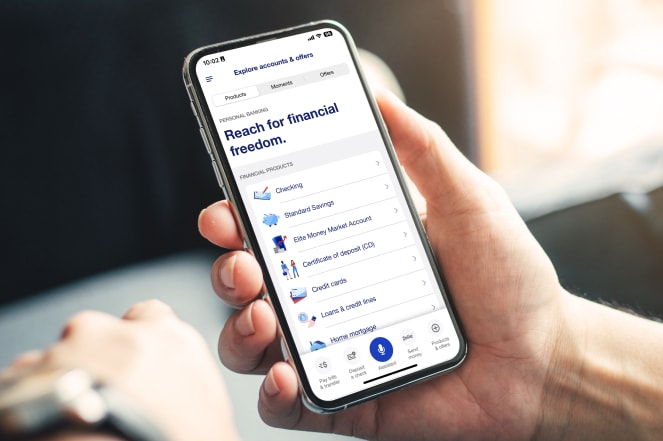

When it comes to saving money, many people may consider keeping their cash under the mattress as a safe option. However, this method poses significant drawbacks. Without the protection and interest growth offered by financial institutions, your savings will lose value over time due to inflation. On the other hand, storing money in the bank not only keeps it secure but also allows for the potential to earn interest, ensuring that your savings grow rather than shrink. This fundamental difference highlights the importance of understanding where to keep your funds for optimal financial health.

Furthermore, banking systems provide various tools and services that enhance the value of your savings. For instance, savings accounts typically offer competitive interest rates, while high-yield accounts can maximize returns on your deposited funds. Additionally, keeping money in the bank provides accessibility and the option to invest further through other financial products. In contrast, simply stashing cash under the mattress limits your saving potential and exposes you to risks such as theft or loss. The debate between these two options clearly illustrates that in the bank is not just safer, but smarter for your financial future.

What Happens to Your Money in the Bank? Understanding Fees and Risks

When you deposit your money in the bank, it becomes part of a complex financial ecosystem that offers numerous benefits but also comes with certain fees and risks. Banks typically pay you interest on your savings, which can be influenced by current market rates. However, it's essential to be aware of potential fees associated with maintaining an account. These may include monthly maintenance fees, overdraft fees, and charges for transactions beyond your account’s limit. Understanding these fees is crucial, as they can significantly impact your overall savings.

In addition to fees, there are inherent risks to consider. Although your deposits are generally insured by the government up to a certain limit, such as through the FDIC in the United States, economic fluctuations can still affect your bank and its operations. If a bank experiences insolvency, there could be delays in accessing your funds. Furthermore, the rise of digital banking and cryptocurrency adds another layer of complexity, as these new financial systems are often less regulated and may carry different risks. Thus, being informed about what happens to your money in the bank is vital for managing your financial future effectively.