Vape Mojo: Your Ultimate Vape Resource

Explore the latest trends, tips, and reviews in the world of vaping.

Why Term Life Insurance is Like a Love Affair: Brief but Meaningful

Discover why term life insurance mirrors a fleeting romance—intense, impactful, and essential for your future. Click to explore the connection!

The Beauty of Term Life Insurance: Short-Term Commitment with Long-Term Impact

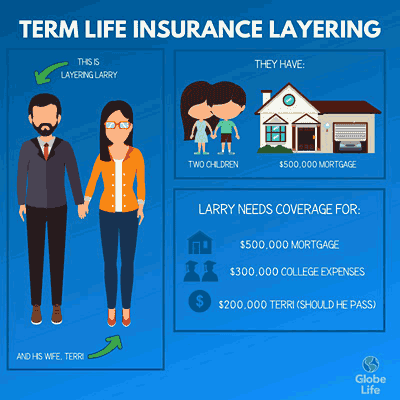

Term life insurance offers a unique blend of affordability and flexibility, making it an appealing choice for many individuals seeking financial protection. Unlike whole life policies that require a long-term commitment, term life insurance allows you to select coverage for a specific duration, typically 10, 20, or 30 years. This means you can tailor the policy to your current lifestyle and financial obligations, such as raising children or paying off a mortgage. Should the unexpected occur during this period, your beneficiaries would receive a substantial payout, providing them with much-needed security and peace of mind.

One of the most compelling aspects of term life insurance is its ability to create a significant impact without a long-term financial burden. For instance, a young family might opt for a 20-year term policy, ensuring that in the event of an untimely death, their loved ones can cover daily expenses, education costs, and debt repayments without struggle. The short-term commitment means that as circumstances evolve—like career advancements or children moving out—policyholders can reassess their needs and adjust their coverage accordingly, facilitating a smart financial strategy that grows with them.

Is Term Life Insurance the Perfect Companion for Your Financial Journey?

When embarking on your financial journey, it's essential to have a solid plan in place, and term life insurance can serve as a valuable tool in that plan. Unlike permanent life insurance, which can be more complex and costly, term life insurance offers straightforward coverage for a specified period, often at a more affordable premium. This makes it an ideal choice for those who want to ensure their loved ones are financially protected during their most vulnerable years, such as while paying off a mortgage or raising children. In essence, term life insurance acts as a safety net, protecting your family’s financial future while allowing you to allocate funds to other vital areas of your financial goals.

Moreover, integrating term life insurance into your financial strategy can help create peace of mind as you pursue other investments and savings. It allows you to focus on building wealth, knowing that your family is safeguarded against unexpected events. Should the worst happen, the death benefit from a term policy can cover outstanding debts, provide living expenses, and fund educational costs for children. Thus, as you navigate your financial journey, consider term life insurance not just as a precaution but as an essential companion that complements your overall financial health and security.

Why Choosing Term Life Insurance Feels Like Falling in Love: A Guide to Brief but Meaningful Protection

Life is full of important decisions, and choosing term life insurance often sparks emotions similar to those experienced in the early stages of falling in love. Just as love encompasses a commitment to protect and cherish one another, term life insurance offers a straightforward, meaningful way to safeguard your loved ones' financial futures during a set period of time. This type of policy provides peace of mind with its simplicity, allowing you to focus on the joys of life while knowing that your family is covered in the event of the unexpected.

When you're in love, every moment feels significant, and similarly, the brief yet impactful nature of term life insurance enables you to make a lasting difference during the period you choose. With affordable premiums and flexible options, it thrives on the idea that protection doesn't have to be complicated or costly. Whether it’s your growing family or a new home, purchasing term life insurance ensures that when the time comes, your loved ones will have the support they need, allowing you to savor the beautiful moments of life together without worry.