Vape Mojo: Your Ultimate Vape Resource

Explore the latest trends, tips, and reviews in the world of vaping.

Why Overpaying for Insurance is So Last Season

Discover how to stop overpaying for insurance and save big! Uncover smart tips and trends to get the best coverage at the right price.

Top Strategies to Avoid Overpaying for Insurance

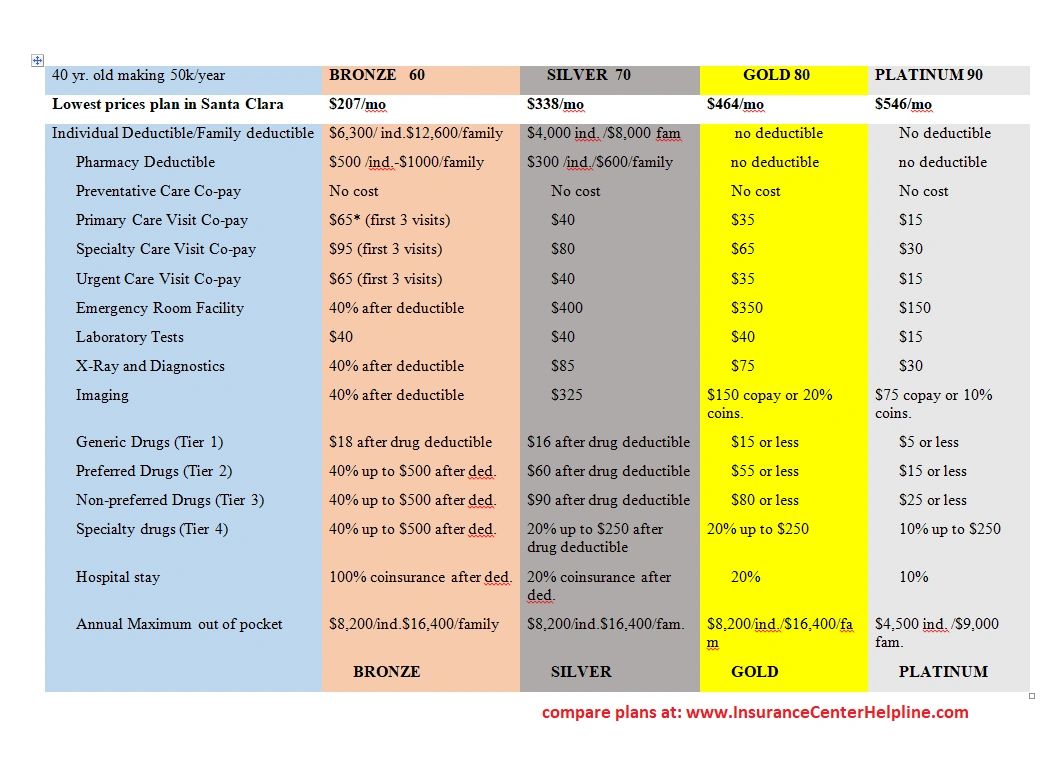

When it comes to purchasing insurance, it’s essential to be strategic in order to avoid overpaying. Comparison shopping is one of the most effective strategies you can use. Take time to gather quotes from multiple insurers, which can vary significantly in price for the same coverage. Use online comparison tools or consult a broker to streamline this process. Additionally, don’t hesitate to negotiate with providers; sometimes, they may offer discounts or match a competitor’s pricing to retain your business.

Another vital strategy is to review your coverage regularly. As your life changes, so do your insurance needs. For instance, if you have paid off a car loan, you might reduce your auto insurance coverage to save money. Furthermore, consider increasing your deductibles; higher deductibles generally lead to lower premiums. Lastly, take advantage of available discounts. Many insurers offer reductions for bundling policies, having a claims-free history, or even being a good student. Keep an eye out for these opportunities to save on your insurance costs.

Is Your Insurance Premium Too High? 5 Questions to Ask Yourself

Are you feeling the pinch of high insurance premiums? Understanding why your rates might be soaring is crucial for financial health. Start by asking yourself: What coverage do I need? Evaluating your insurance needs will help you distinguish between essential coverage and unnecessary add-ons. Consider a few factors such as your lifestyle, the assets you want to protect, and any regulatory requirements. This reflection can pave the way for a more tailored insurance plan that won't break the bank.

Another important question to ponder is: Am I taking advantage of available discounts? Insurance providers often offer various discounts for things like bundling policies, having a good driving record, or even being a member of certain organizations. Make sure to inquire about these options, as they can significantly reduce your premium. Additionally, ask yourself: When was the last time I compared rates? Shopping around for different providers can expose you to more competitive rates, ultimately leading to savings that could alleviate your financial burden.

The Hidden Costs of Overpaying for Insurance: What You Need to Know

Many individuals and families unknowingly overpay for insurance, believing that higher premiums equate to better coverage. However, this assumption can lead to significant hidden costs that impact your financial health. The hidden costs of overpaying include not just the excess money spent on premiums, but also potential gaps in coverage that can arise from ill-informed choices. It’s essential to regularly review your insurance policies to ensure that you’re not just throwing money away on plans that do not adequately meet your needs.

When considering how to minimize insurance expenses, it’s crucial to evaluate what you're actually getting in return for those higher payments. For instance, a policy with an unclear or complicated terms of service may end up being less useful than a more transparent and affordable option. Additionally, premium payments could restrict your ability to allocate funds to other financial priorities, such as savings or investments. By examining both the visible and hidden costs of insurance, you can make smarter, more informed decisions that benefit your overall financial well-being.