Vape Mojo: Your Ultimate Vape Resource

Explore the latest trends, tips, and reviews in the world of vaping.

Whole Life Insurance: Not Just for Life's Emergency Exit

Discover why whole life insurance is more than just a safety net—uncover its surprising benefits and secure your financial future today!

The Benefits of Whole Life Insurance: More Than Just a Safety Net

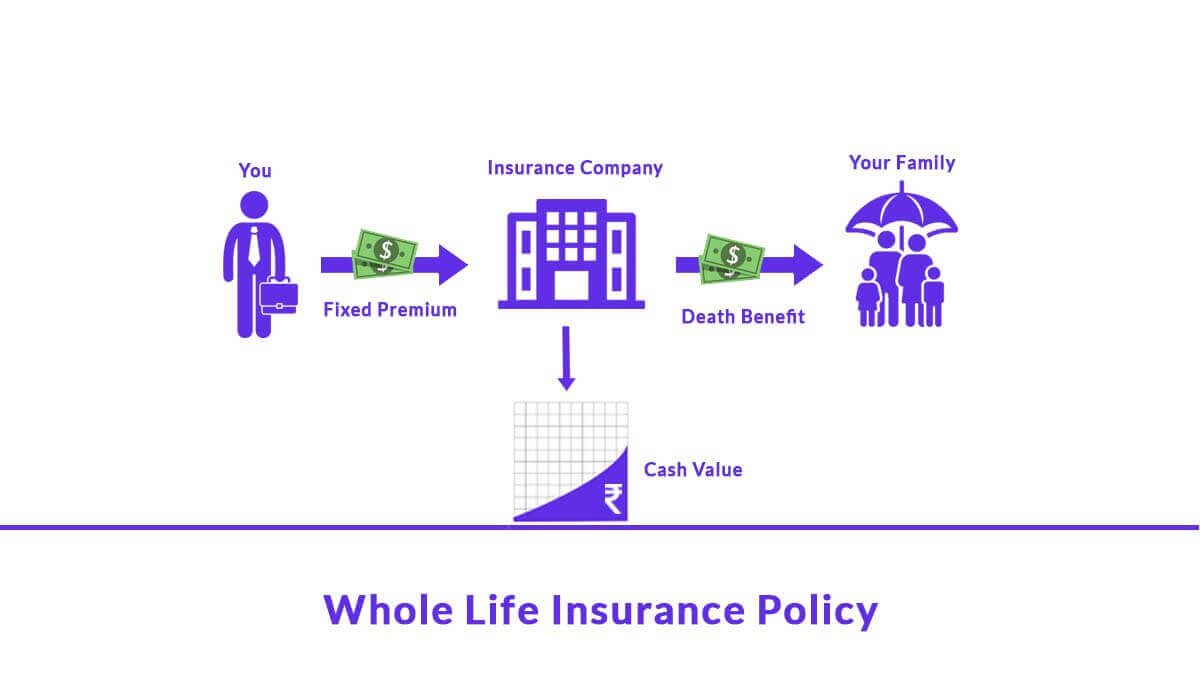

Whole life insurance offers a myriad of benefits that extend beyond mere financial protection for your loved ones. One of the primary advantages is the cash value accumulation. Unlike term life insurance, which expires after a set period, whole life policies grow in value over time, providing policyholders with a financial asset that can be borrowed against or withdrawn in times of need. This inherent savings component allows individuals to build wealth while securing their family's future, making it a versatile option for long-term financial planning.

Furthermore, whole life insurance guarantees lifetime coverage as long as premiums are paid, which assures peace of mind for policyholders. Many plans come with fixed premiums that do not increase as the insured ages, making budgeting for life insurance easier. Additionally, whole life insurance can provide tax advantages, such as tax-deferred growth on the cash value and tax-free death benefits for beneficiaries. Overall, the multifaceted benefits of whole life insurance make it an attractive option for those seeking both security and an investment opportunity.

Understanding the Cash Value Component of Whole Life Insurance

Whole life insurance is a unique financial product that not only provides a death benefit but also includes a cash value component. This cash value accumulates over time as you pay your premiums, functioning like a savings account within your policy. As you commit to your premiums, a portion of each payment contributes to the cash value, which grows at a guaranteed interest rate and can be accessed during your lifetime. Understanding this aspect is crucial for policyholders as it can serve as a source of funds for emergencies or major life events.

Moreover, the cash value of whole life insurance is a key feature that differentiates it from term life insurance, which offers no cash accumulation. Policyholders have the option to borrow against the cash value or withdraw funds, providing financial flexibility. However, it's important to remember that taking loans or withdrawals can reduce the death benefit and may incur interest. Therefore, anyone considering whole life insurance should carefully weigh the implications of the cash value component in their overall financial strategy.

Is Whole Life Insurance Right for You? Key Questions to Consider

When evaluating whether whole life insurance is the right choice for you, it's essential to consider your financial goals and needs. Unlike term life insurance, which provides coverage for a specific period, whole life insurance offers lifelong coverage and includes a cash value component that grows over time. Here are some key questions to ponder:

- What are your long-term financial goals?

- Do you want a policy that appreciates over time?

- How important is the stability of premium payments to you?

Another critical aspect to consider is your current financial situation and personal circumstances. For instance, if you have dependents relying on your income, investing in whole life insurance could provide them with financial security in the event of your untimely passing. Additionally, assess your ability to commit to higher premium payments that typically come with whole life policies. Consider these questions:

- Can you afford the premiums without straining your budget?

- Do you have a reliable income stream for the long term?

- Are you prepared for both the benefits and constraints that come with a long-term commitment?