Vape Mojo: Your Ultimate Vape Resource

Explore the latest trends, tips, and reviews in the world of vaping.

Say Goodbye to Overpaying with These Insurance Quotes

Discover how to save big on insurance! Uncover unbeatable quotes and stop overpaying today. Your wallet will thank you!

5 Tips to Comparing Insurance Quotes for Maximum Savings

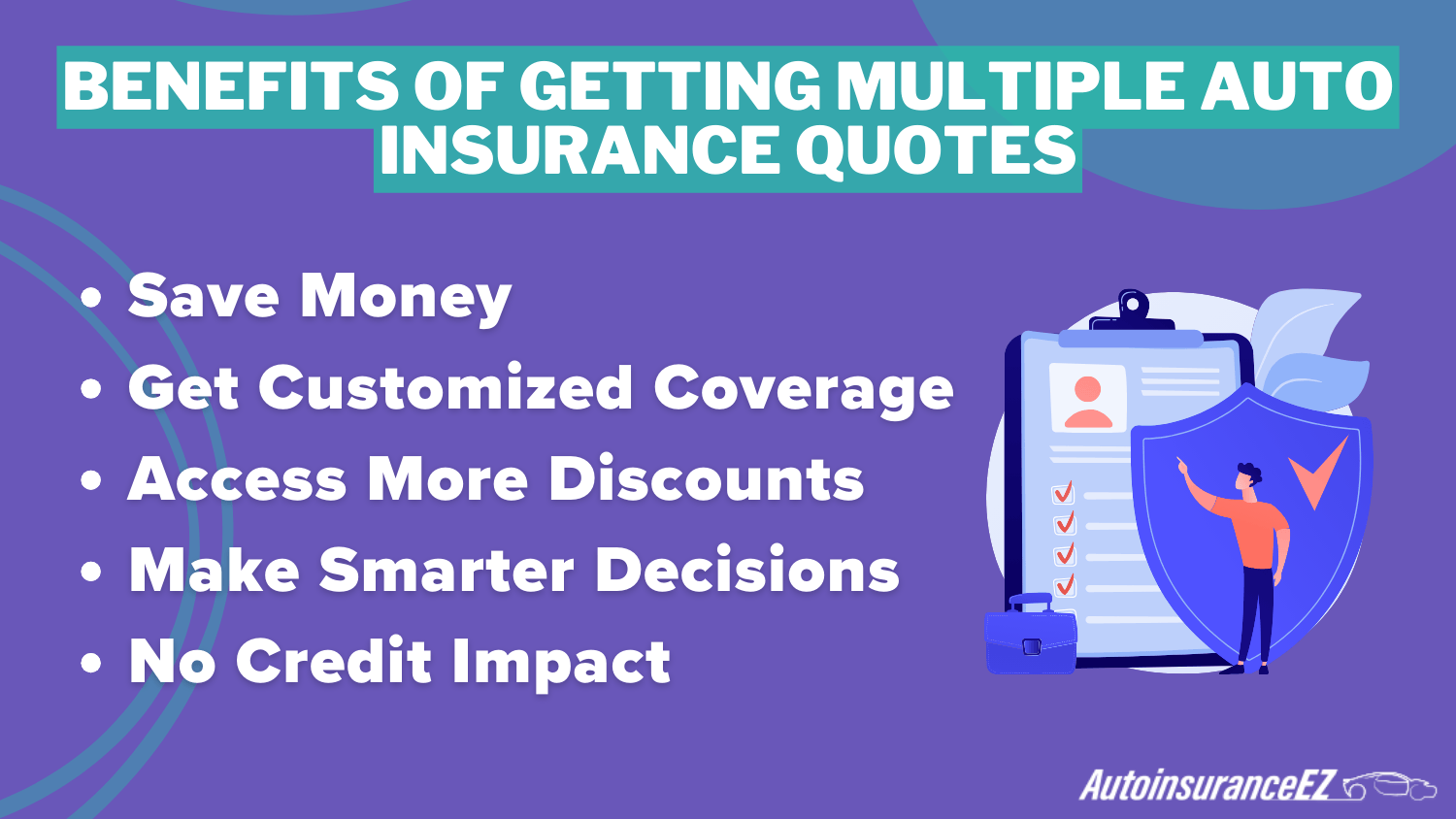

When it comes to comparing insurance quotes, the first step is to gather multiple quotes from different providers. This allows you to see the price range and coverage options available. Start by making a list of at least five insurance companies and use their online tools or contact them directly for quotes. Ensure you provide consistent information across all applications, as even a small change in details can significantly affect the quotes you receive. This initial groundwork is crucial for ensuring you are comparing apples to apples rather than apples to oranges.

Another essential tip is to analyze the coverage included in each quote. Look beyond just the premium amount; dive deeper into the details of what each policy covers. This includes examining deductibles, limits, and any additional benefits or exclusions. Create a comparison chart to gauge these factors side by side. Additionally, don’t hesitate to ask questions about any terms or conditions you don’t understand. A comprehensive analysis will help you identify the best combination of coverage and cost, maximizing your savings in the long run.

Are You Overpaying for Insurance? Here’s How to Find Out

Many individuals and families may not realize they're overpaying for insurance, leading to unnecessary financial strain. One of the first steps to determine if you are paying too much is to conduct a thorough review of your current policies. Compare rates from multiple providers to see if better options are available, and consider factors such as coverage limits, deductibles, and customer service ratings that might impact your choice. Utilizing online comparison tools can streamline this process, making it easier to spot discrepancies in pricing and features.

Another key strategy is to evaluate your insurance needs regularly. Life changes, such as marriage, moving, or starting a family, often alter your coverage requirements. It's advisable to speak with an insurance expert who can assess your situation and recommend adjustments. Additionally, inquire about discounts you may not be aware of, such as bundling policies or maintaining a claims-free history. By actively engaging in your insurance choices, you can ensure that you have the right coverage at a competitive rate, thus avoiding the pitfalls of overpaying for insurance.

Understanding Insurance Quotes: What You Need to Know to Save Money

When it comes to understanding insurance quotes, the first step is to recognize that these quotes represent an estimate of your potential insurance premiums based on various factors. Insurers evaluate details such as your age, driving record, location, and the type of coverage you seek. By boosting your knowledge about what goes into these calculations, you can better compare multiple quotes and identify areas where you might save money. Take the time to inquire about discounts for bundling policies, maintaining a good credit score, or even driving safely, as these can greatly influence your final rate.

Another crucial aspect of insurance quotes is deciphering the different coverage options available to you. It’s easy to get overwhelmed by the technical language used in insurance documentation, but understanding terms like deductibles, premium, and coverage limits can empower you to make informed decisions. To ensure that you are receiving the best value, consider creating a comparison chart listing the most important features of each policy. Remember, choosing the cheapest option isn't always the best; quality coverage should always be a priority when looking to save money in the long term.