Vape Mojo: Your Ultimate Vape Resource

Explore the latest trends, tips, and reviews in the world of vaping.

Don't Let Your Stuff Go Bare: Why Renters Insurance Is a No-Brainer

Protect your belongings! Discover why renters insurance is essential and how it saves you from costly surprises. Don't risk it!

What Is Renters Insurance and Why Do You Need It?

Renters insurance is a type of insurance policy that provides coverage for tenants living in rental properties. This insurance protects personal belongings against risks such as theft, fire, and water damage, offering peace of mind to those who may have substantial investments in their possessions. In addition to covering personal property, many policies also provide liability coverage, which can protect you against legal claims if someone is injured on your rented property. Without this coverage, you might find yourself facing significant expenses in the event of an unforeseen incident.

So, why do you need renters insurance? Firstly, many landlords require tenants to carry insurance as part of the lease agreement, meaning that having a policy can help you secure your rental. Secondly, renters insurance is typically quite affordable, with average monthly premiums costing less than a meal out. Finally, having this insurance can offer crucial financial protection, allowing you to replace stolen or damaged property without incurring substantial personal costs. In today's world, safeguarding your belongings with renters insurance is not just a smart choice, but a necessary one.

5 Common Misconceptions About Renters Insurance Debunked

Many people believe that renters insurance is only necessary for those with expensive items, such as electronics or jewelry. However, this is a common misconception. In reality, renters insurance is designed to protect your personal belongings regardless of their value. Even if you only have basic furniture and clothing, the costs to replace these items can add up quickly in the event of theft, fire, or water damage. Without this coverage, you may find yourself facing significant financial burdens to replace essential items you assumed were safe.

Another prevalent myth surrounding renters insurance is that it doesn't cover liability. This misunderstanding can lead to severe consequences. Most policies actually include a liability component, which protects you if someone is injured on your rental property. If a neighbor slips and falls in your apartment, liability coverage can help cover medical expenses and legal fees. It's essential to know that having renters insurance not only shields your belongings but also provides crucial financial protection against potential lawsuits.

How to Choose the Right Renters Insurance Policy for Your Needs

Choosing the right renters insurance policy is crucial to protecting your personal belongings and financial well-being. Start by evaluating your needs: Consider the value of your possessions and the level of coverage you require. Create an inventory of your items, including electronics, furniture, and clothing, to determine how much insurance may be necessary. Look for policies that offer replacement cost coverage, which pays for the full amount to replace an item, rather than its depreciated value.

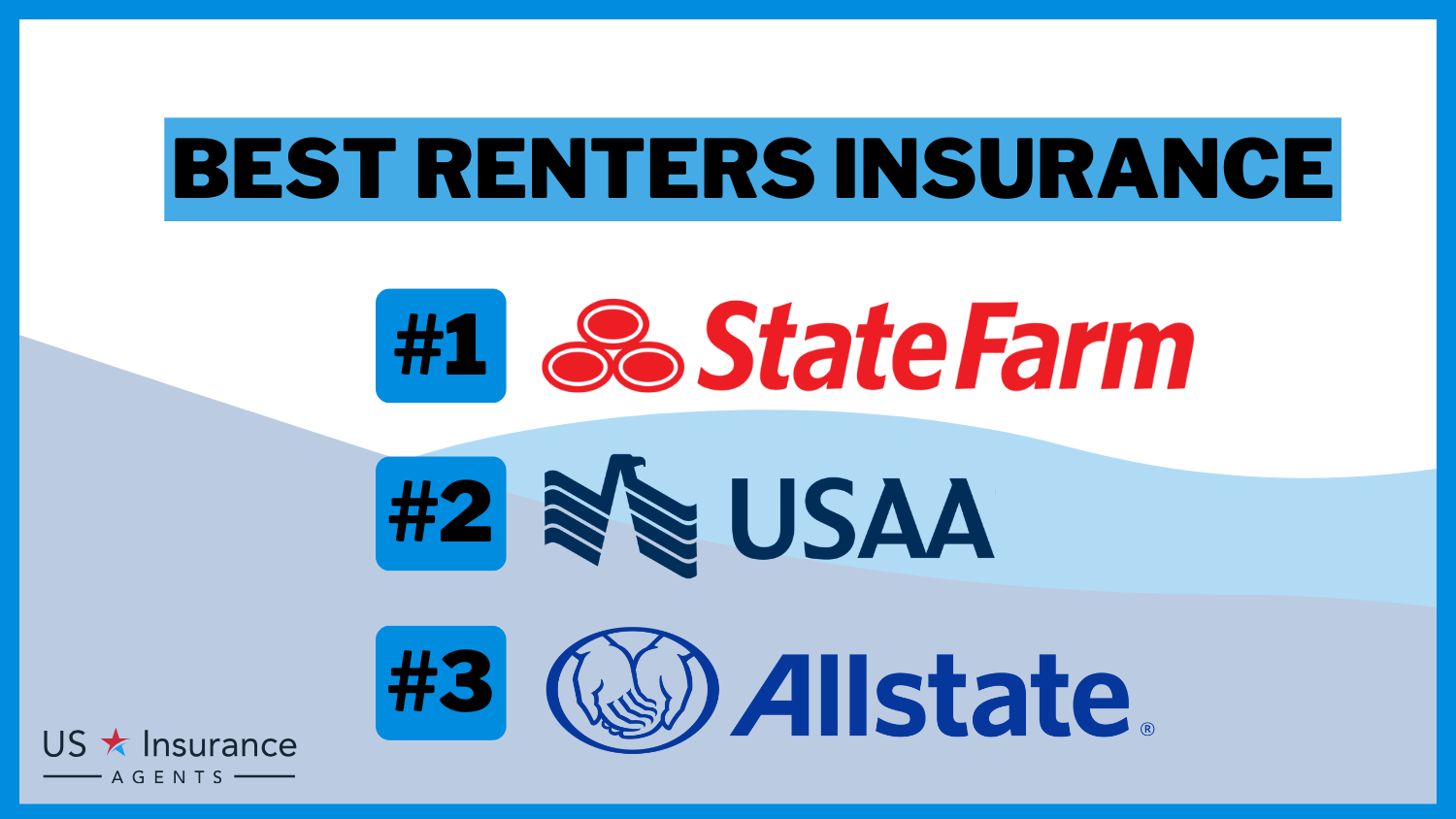

Next, compare different insurers to find a policy that fits your budget and coverage requirements. Be sure to read the fine print to understand any exclusions or limitations in the policy. Additionally, check if the insurer offers discounts for factors like bundling policies or having security features installed in your home. As you make your decision, consider seeking input from friends or family who have rented before, as personal experiences can provide valuable insights into which providers are reliable and offer the best customer service.