Vape Mojo: Your Ultimate Vape Resource

Explore the latest trends, tips, and reviews in the world of vaping.

Insurance for Small Businesses: A Safety Net or Just a Safety Nuisance?

Explore if insurance for small businesses is a crucial safety net or a costly nuisance—discover what you need to know to protect your investment!

Is Business Insurance Worth the Investment for Small Businesses?

When it comes to protecting your small business, business insurance plays a crucial role. It provides a safety net that can shield you from unexpected financial burdens arising from accidents, natural disasters, or lawsuits. For many small business owners, the costs associated with these incidents can be devastating, often threatening the sustainability of their business. With the right business insurance, you gain peace of mind knowing that you are prepared to handle these risks, allowing you to focus on growth and operations without the looming worry of financial setbacks.

Moreover, investing in business insurance can enhance your credibility and reliability in the eyes of clients and partners. Many prospective customers prefer to work with insured businesses, viewing insurance coverage as a sign of professionalism and responsibility. Additionally, certain contracts may even require proof of insurance before a business can commence work. Thus, while the upfront costs may seem daunting, the long-term benefits of having business insurance can far outweigh the initial investment, making it a wise choice for any small business owner committed to success.

Common Misconceptions About Insurance for Small Businesses

Many small business owners believe that insurance is an unnecessary expense, often assuming that their business is too small to warrant protection. However, this is a significant misconception. Even the smallest business can face unexpected challenges, including property damage, liability claims, or employee injuries. Without adequate insurance, these challenges can lead to substantial financial losses and potentially jeopardize the sustainability of the business. Therefore, investing in the right types of insurance is crucial for the long-term viability of any small business.

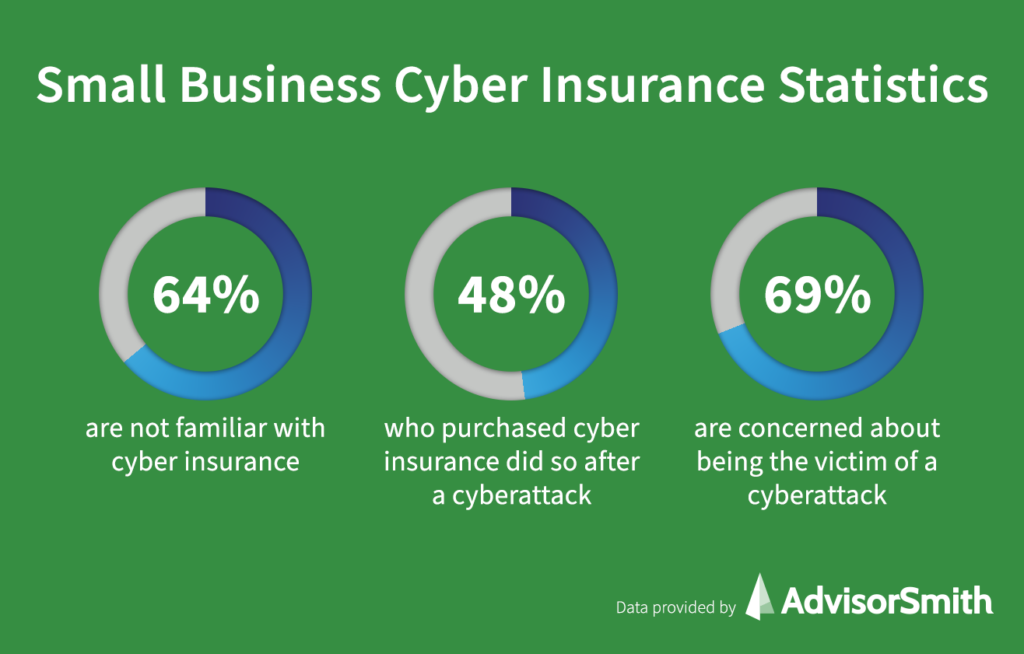

Another common myth is that all insurance policies are the same and that they provide blanket coverage for every situation. In reality, insurance policies can vary significantly depending on the industry, business size, and specific needs. For example, a tech startup may require cyber liability coverage, whereas a retail store may need protection against inventory loss. It's essential for small business owners to work with a knowledgeable insurance agent who can tailor a policy to meet their unique risk profile and ensure comprehensive coverage.

How to Choose the Right Insurance Policy for Your Small Business

Choosing the right insurance policy for your small business is essential to protect your assets and minimize risks. Start by assessing your business needs and identifying potential risks. Consider factors such as your industry, the size of your business, and any specific liabilities you may face. Create a list of coverage options that align with your business model, such as general liability, property insurance, and professional liability. This initial assessment will guide you in selecting a policy that provides the necessary coverage.

Next, compare different insurance providers and their policy offerings. Look for companies with a strong reputation and positive customer reviews. It’s beneficial to request quotes from multiple insurers to evaluate costs and coverage options. Additionally, consider the policy's terms, exclusions, and limits to ensure you are making an informed decision. Finally, consult with an insurance agent or broker who specializes in small business insurance to help you navigate the complexities and find a policy tailored to your needs.