Vape Mojo: Your Ultimate Vape Resource

Explore the latest trends, tips, and reviews in the world of vaping.

Insurance Quotes Unfiltered: What They Don’t Want You to Know

Uncover the truth behind insurance quotes! Discover secrets the industry doesn't want you to know and save money today!

The Hidden Truths Behind Insurance Quotes: What the Industry Won't Tell You

When seeking insurance quotes, many people assume they are getting a straightforward view of potential costs. However, the hidden truths behind insurance quotes reveal a more complex reality. For instance, many factors influence the final premium that aren't always disclosed upfront. These can include your credit score, claims history, and even geographical location. Understanding this can empower you to make informed decisions and negotiate better rates.

Moreover, it's essential to realize that not all insurance quotes are created equal. Often, underlying assumptions in these quotes aren't made explicit. For example, some insurers use specific algorithms to assess risk that may not reflect your unique situation. Evaluating the fine print in each quote can reveal vital information about coverage limits, exclusions, and deductibles that could significantly impact your overall out-of-pocket costs. In the end, knowledge is power in navigating the insurance landscape.

Decoding Insurance Quotes: Common Myths and Misconceptions Explained

When it comes to insurance quotes, many people fall victim to common myths that can skew their understanding of the process. One prevalent misconception is that the lowest quote always equates to the best coverage. In reality, not all policies are created equal; a budget-friendly option might lack critical protections. It's vital to compare not just prices but also the coverage options, exclusions, and limits of each policy to ensure you are making an informed decision.

Another myth is that obtaining insurance quotes requires a lengthy and daunting process. Many individuals shy away from seeking quotes, believing it entails extensive paperwork and numerous phone calls. However, most insurance companies today offer streamlined online quoting systems that allow consumers to receive multiple quotes within minutes. This accessibility makes it easier than ever to explore different options and find a policy that meets both your needs and your budget.

Are You Overpaying? Essential Tips to Get the Best Insurance Rates

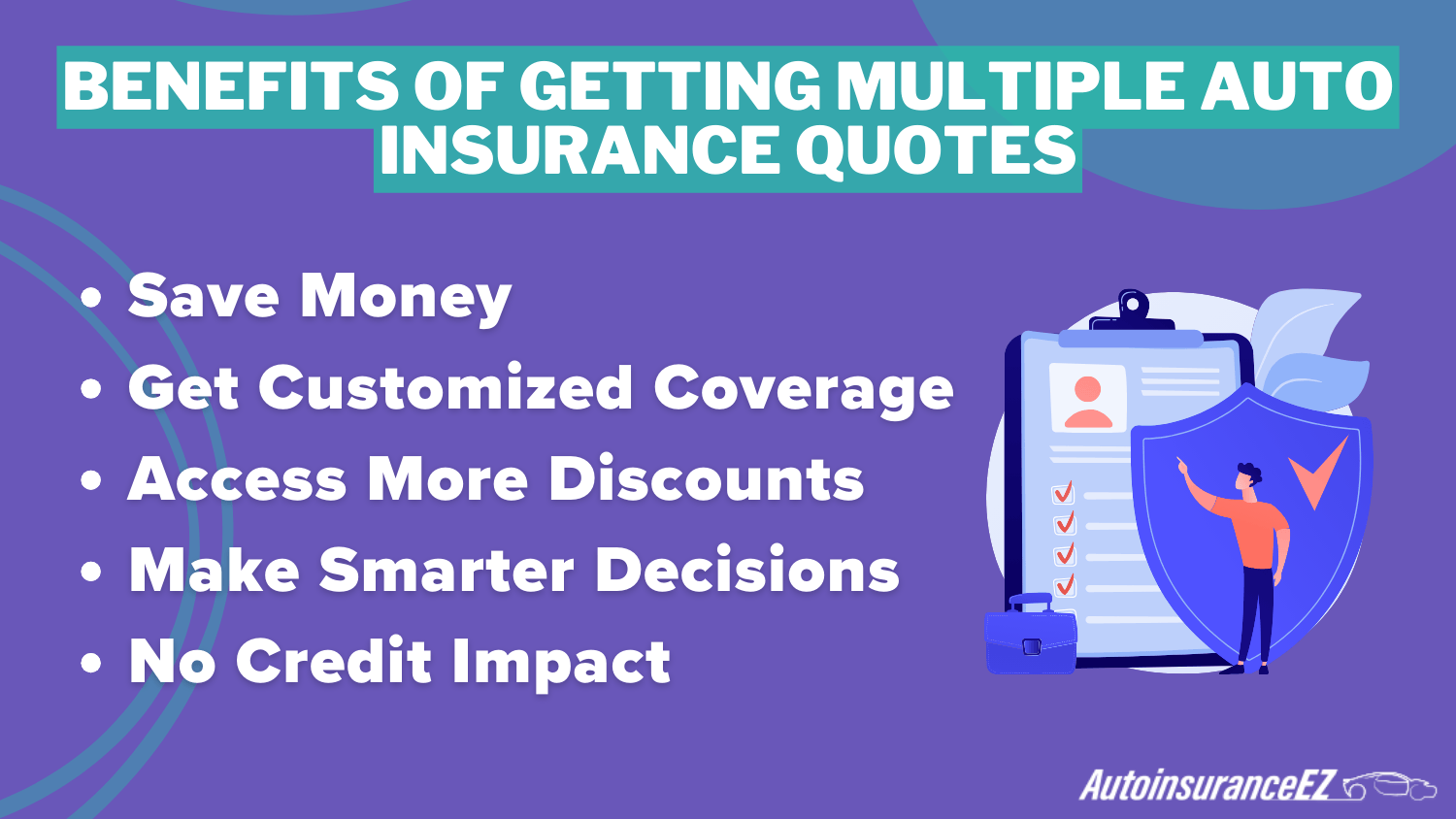

Are you overpaying for your insurance? Many consumers unknowingly spend more than necessary on their policies. To ensure you get the best rates, start by comparing quotes from multiple providers. Websites like insurance comparison tools can simplify this process, allowing you to see the differences in coverage and costs at a glance. Additionally, consider the type of coverage you really need; often, people pay for add-ons they may not utilize. Performing an annual review of your policies is a smart way to reassess your coverage and expenses.

Another effective strategy is to take advantage of discounts offered by insurers. Most companies provide savings for bundling policies, maintaining a clean driving record, or even for being a good student. Don’t hesitate to ask your insurance agent about potential discounts; being informed can save you a significant amount of money over time. Finally, consider increasing your deductible; while this means you’ll pay more out-of-pocket in the event of a claim, it can drastically lower your monthly premiums. By following these essential tips, you can ensure you're not overpaying for your insurance.